Stop procrastinating over your retirement plans. Do this instead

With so much going on in your life, you’d be forgiven for procrastinating over “boring” financial administration tasks.

While keeping on top of your company’s finances is hugely important, you could focus most of your energy on that, and as a result, let important personal financial planning slip past you.

If you’re approaching retirement, however, your procrastination could be costing you the comfortable lifestyle you want.

Keep reading to discover why so many people bury their heads in the sand, and how to stop procrastination in its tracks and whip your retirement plan into good shape.

Retirement planning involves spinning many plates at once

Psychologist and procrastination expert Fuschia Sirois says that procrastination is not down to laziness, poor time management, or disorganisation. It’s actually to do with emotional regulation. Sirois says that procrastination is a “short-term mood repair”, as we tend to procrastinate over tasks that have negative emotional associations, such as stress or frustration.

Looking ahead towards your retirement, your excitement could be outweighed by financial worry, or even concern that your “purpose” won’t be fulfilled once you stop work. You may not even realise you’re procrastinating over important tasks, such as creating a will, reviewing your tax position, or considering whether your personal wealth will sustain you in retirement.

With so many plates to spin – and a business to run in the meantime, balanced with family life – you may simply bury your head in the sand and hope your retirement will work itself out.

But this isn’t always the case. With the cost of living rising, you may be surprised by how much a comfortable lifestyle costs you. Plus, if your retirement will be partially or fully funded by the sale of your business, you may not be able to guarantee the final payout amount. Assessing your options and planning ahead is essential.

Split your retirement plan into “goals” and “needs”

It often helps to break down big-ticket tasks – those that can’t be ticked off in a day and forgotten about – into smaller chunks. Retirement planning falls into this category because it’s an ongoing process that needs to be reviewed at least once a year.

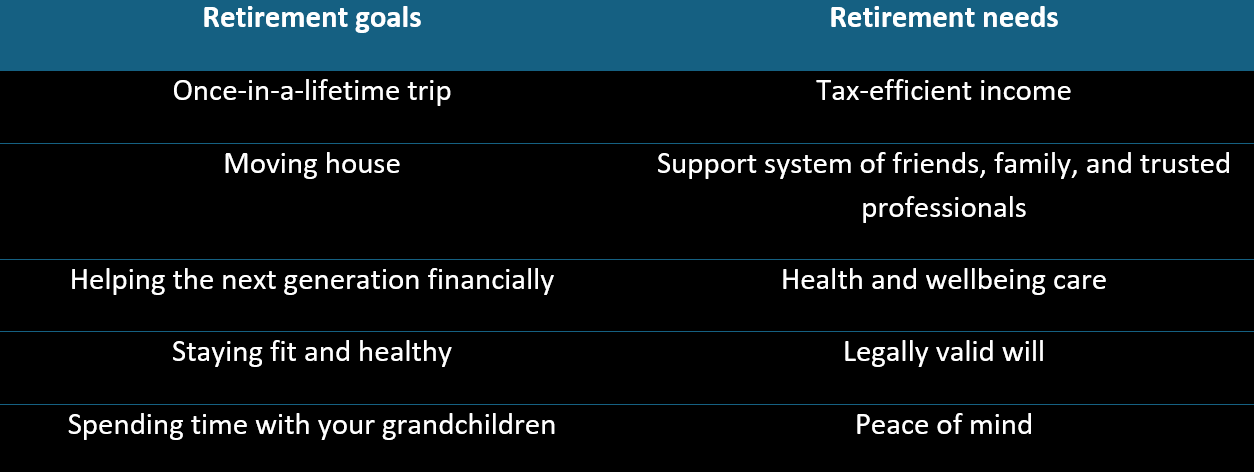

Defining the difference between your needs and goals could help you break up your retirement planning tasks.

By identifying your needs – a mixture of health, wellbeing, and financial – you can plan ahead and ensure you meet them. Once your neeSds are met, this leaves room for you to pursue your goals without worrying about the fundamentals.

Read more: Are you underestimating your retirement needs? 3 ways to work out your “number”

Stop procrastination in its tracks with these 5 helpful tips

If you’re a top procrastinator, perhaps it would help to list your needs from most to least important (and afterwards, do the same for your goals). Then, each week or month, pay close attention to one item on your list, and take a step towards meeting it.

This could look like:

- Checking your pension contributions and increasing them if possible

- Reviewing your will and speaking to a legal professional about updating it, if necessary

- Requesting valuation statements from pension and investment providers

- Thinking carefully about the lifestyle you want in retirement, and researching the costs involved.

Of course, all this is easier said than done.

Here are five helpful tips to prevent procrastination.

1. Put time in your diary to complete a task. Half an hour each week or month will do. Once it’s built into your schedule, you will find it harder to avoid.

2. Ask someone to hold you accountable. Your spouse, a colleague, a friend, or even your financial planner could hold you to account for the tasks you’re missing. For instance, if you set time aside on a weekday evening, tell your spouse about it; that way, someone else is aware of your plan and will check whether you have completed it.

3. Reward yourself. Your favourite coffee shop is the perfect place to spend some time on “boring” retirement admin. With a delicious cappuccino in hand and a relaxed atmosphere, you may be better placed to get the job done.

4. Attach meaning to each task. Think about the long-term effects of what you’re doing today. When you increase your pension contributions, for instance, use a long-term compound returns calculator to understand how much of a positive impact this may have on your retirement.

5. Find time-management techniques that work for you. Some people swear by the “pomodoro technique” – working in 25-minute bursts – while others find it helpful to simply set a short timer and focus until it goes off.

Together, these procrastination hacks could help you break away from old patterns and ensure you’re productively planning for the future you want.

Work with us at iQ Financial

Whether you are already retired, about to, or a long way off, our financial planners can support you in your personal wealth journey.

We work exclusively with business owners to ensure their personal wealth is managed properly and tailored towards their goals.

To get started, email us at clients@iqf.ie, or call 353 71 915 5560.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

iQ Financial is not a tax adviser and tax advisory services are not regulated by the Central Bank of Ireland.

Financial planning services are not regulated by the Central Bank of Ireland.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.